Selecting the Right Performance Measures for Your Incentive Plan

December 06, 2023 • By Ken Gibson

A successful incentive plan isn't achievable unless it built on the right premise. Stated another way, most incentive plans fail because they are built on a faulty premise. Company leaders create them believing they can be used to impact employee behavior. When their plan doesn't prompt the anticipated change, those leaders claim it didn’t “work” and become frustrated. They then alter the plan metrics thinking that will solve the problem. But, if they started with the wrong premise, the new metrics only compound the problem. So, let’s solve this dilemma, shall we?

To design a bonus or other short-term plan effectively, you must start by correctly identifying the purpose of your offering. Sharing value with employees is a way to define the financial partnership you want to have with them. You are essentially inviting them to share your vision for the company and communicating the outcomes that need to be achieved to fulfill it. Further, through the way you are paying them, you are identifying how they will participate in the value they help create as they help build the future company; in other words, how they will be rewarded for achieving the outcomes their role exists to produce.

The premise, then, upon which an incentive plan should be built is value creation. It should grow out of a company philosophy which holds that employees will share in the wealth multiple they help create. And as more value is created, more value-sharing can occur. And that is the term that should be used to describe the plan the organization is creating--value-sharing. When you build a plan on a value-sharing premise, people are not rewarded for their behavior. They are rewarded for creating value. And the value creation that results in highest value-sharing should be that which most aligns with shareholder interests. So, what might that be?

The Primary Focus

Presumably, if you lead a business, your primarily focus each year is profits. Your business growth depends upon it. What, then, should be the primary measure upon which an incentive plan should be based? Yes, profit. This does not mean you can’t have other metrics and measures. But it does mean that profit should be primary. In other words, it doesn’t matter how many other measures the company or department or individual meets. If a certain profit threshold is not achieved, incentives are not paid.

This makes the development of other performance metrics easier not harder. Every measure becomes outcome based. As a result, the core question in building metrics becomes: “Will this outcome drive greater profits?” or "What outcome can this role produce that will increase profits?" If an outcome doesn't result in greater profits, then that metric should probably be rejected or modified. And that leads to the other issue that must be addressed in defining measures and metrics.

One Value-Sharing Philosophy, Two Performance Periods

You should not develop an incentive plan that improves profits today at the expense of sustained growth. Those are considered "bad" profits. And they occur too often. They occur because business leaders unknowingly encourage them by offering incentives that are rooted in the wrong premise. Here's what I mean: A company sets up an annual bonus plan that maximizes payouts for achieving short-term performance goals. This compromises employee decision-making. They may end up exploiting a customer, vendor or other department in their company to enrich themselves while eroding long-term value creation in the process. Profit is still generated, but it’s bad profit.

The answer to this problem is to think in terms of two performance periods when building an incentive plan. One is the next 12 months. Here, the focus is on achieving outcomes that improve revenue growth, expand margins or lower costs (or all three) but without damaging sustained growth. The second focuses on rewarding enduring performance—results that drive business growth and increase shareholder value. This is achieved by ensuring your employee “growth partners” are focused on outcomes that will improve business value (product development, acquisitions, new technology, expanded markets, etc.). Rewards, then, for short-term performance should be tied to profits. And long-term rewards should be tied to business value increase. Why? Because they are correlated. You need profits to drive growth. And employees are more likely to produce good profits if it works against their financial interest to think short-term.

So, to summarize, the primary metric for a short-term plan should be profit. And long-term plan benefits should be tied to a metric rooted in business value increase (which is really just sustained profits).

For both performance periods, the role of the primary metric is to accomplish the following:

- Encourage performance that results in outcomes that align with shareholder interests (increased profits and increased business value).

- Communicate the priorities and outcomes each person should be producing in their role.

- Reward both short and long-term performance.

Remember, value-sharing is not initiated in an effort to change behavior or "motivate" employees, per se. Motivation is intrinsic and each employee will have their own reasons to be committed to high performance. However, motivation is facilitated when employees' roles and tasks are aligned well with their unique abilities and are consistent with the purposes they want to serve or advance. Motivation is further engendered by a shared vision and values between the company and its workforce.

On the other hand, if performance standards are not clearly defined and properly rewarded, an incentive plan can potentially deflate the motivation of employees. This happens when a member of the workforce doesn't feel as though there is alignment between his or her role and how rewards are earned. This creates frustration and disillusionment, two conditions that are at odds with a positive focus and a high-performance culture.

Two Core Approaches

Once you have established profit as the primary metric for your short-term plan, there are essentially two approaches you can take in constructing your plan. One is to base it solely on profits. The other is to identify other key performance indicators (KPIs) you would like to introduce in addition to the profit threshold. Let’s look at each.

Profit-Based Allocation

Under this approach, a company decides that it will allocate a percentage of annual profits to employees. The award amount is divided among participants based on a pre-determined formula. Typically, payouts occur at year end, but some companies prefer to make those payments quarterly.

As indicated, the focus of this kind of plan is solely on annual profits. As a result, the incentive value created can be open ended (unlimited). This can be good or bad (more on that issue in a minute). The design of this kind of incentive is relatively simple; however, it is essential that it be accompanied by a strong performance management system. This is because in a profit-based incentive environment, rewards are driven strictly by company performance, not individual or department performance. As a result, a separate management system needs to be in place to reinforce the outcomes that have to be achieved to drive the right level of profits.

The Profit-Based Allocation has some inherent dangers or drawbacks. This approach does not always create the complete "line of sight" an organization wants reinforced by its compensation strategy. Also, because the plan is centered solely on company performance, employee apathy can set in and morale issues can arise. Consequently, if there is a lack of a strong performance management system in the organization, this approach can be troublesome.

With those dangers in mind, in a "best practices" framework, a Profit Based Allocation should address and/or account for the following issues:

- Define profits - whether it will be some version of EBITDA, net income or some other measure. Also, the company must determine if there will be an economic “value-added” component to measuring profits, accounting for a certain return that must be achieved by shareholders before value inures to the benefit of employees.

- Select either a "Benchmark" or "Growth" Approach - establishing the baseline upon which contributions to the profit pool will be based. Most companies determine to set a standard upon which (or above which) performance must be achieved for incentive formulas to kick in. Others base incentives on the growth of profit each year - so as not to pay incentives during periods of stagnation.

- Identify a Performance Threshold - this ensures that a certain measure of profits (or benchmark improvement) has to be achieved before any payments are made under the plan.

- Select Percentage to Share (fixed or tiered) - this will establish the amount of profits (however determined) that will be distributed in the form of awards. This can be a fixed amount for everyone or different for various "tiers" of employees within the organization.

- Select Allocation Formula - to determine how the potential value will be communicated to participating employees (percent of salary, pro-rata allocation of pool, etc.)

- Determine Personal Performance Component - this is to define whether there will be a certain personal performance standard that will impact the degree to which an employee will/can earn benefits. It modifies the payout up or down.

Targeted KPIs

The theory behind the KPI approach is that improvements in the focus and execution of employees on the issues they are best positioned to impact will lead, ultimately, to improvements in profits.

A plan that uses KPIs can incorporate company, department or individual metrics—or all three. The value of the plan is typically capped, and its design can run from quite simple to very complex. What is essential in this approach is selecting the right metrics. This means you are going to identify indicators that will be used to measure performance in each area. For example, company metrics might be a combination of revenue growth and net income. Departmental indicators could be such things as improvement in company retention or an increase in the collection rate on accounts receivable. Individual metrics would be tied to personal performance goals and productivity factors.

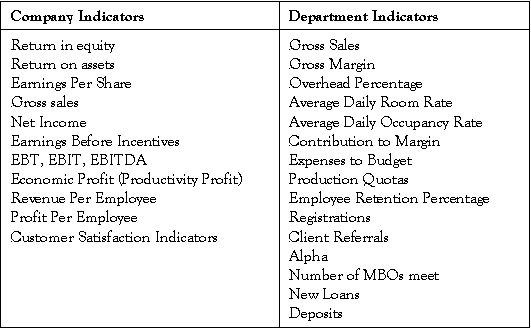

Here are some examples of company and department indicators that we have seen used in the past effectively. Of course, their application will vary depending on industry and other factors.

The dangers with the KPI approach can include the following (among other things):

- Miscalculation (i.e., KPI improvements did not sufficiently offset failure to execute in other areas). This can lead to a company making incentive payments even though profits did not arise. This is why it is important to have a minimum profit target that must be met before incentives are paid.

- Gaming (i.e., employees learning how to achieve the KPIs but without respect to the profit goals). This can lead to intentional or unintentional failure to achieve profit objectives.

- Sandbagging (i.e., employees barely reaching KPIs while determining to carry-over performance into the next period). This can lead to failure to achieve full profit potential.

- Misalignment (i.e., forcing employees into behavior that moves them outside their skill sets and abilities). This occurs when extrinsic motivation overrides intrinsic motivation. The KPIs may be achieved while job satisfaction diminishes.

In our experience, KPI approaches work best if they incorporate the following elements.

Range of Incentive

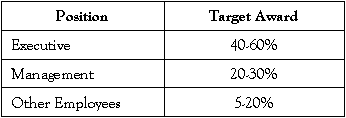

Attractive target incentives should be established for each position. In general, growing companies size their incentives in a range of 25% to 100% of salaries for senior executives. Of course, lower ranges are set for the other tiers.

Sample

Components of Incentive Calculation

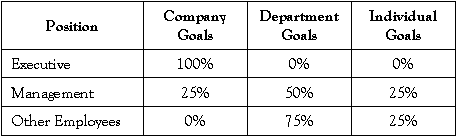

Next, the company should determine how much of an individual's incentive will be based on (a) company performance, (b) department/division performance, and (c) individual performance.

Sample

The determination of this weighting is predicated on the degree of impact each person (position) is deemed to possess relative to the associated result area.

Key Determinants (Drivers)

Company Drivers

Metrics to consider for company performance might include:

- Productivity Profit

- Revenue-to-Budget

- Net Income-to-Budget

- ROTRI™ (Return on Total Rewards Investment)

- Net Free Cash Flow

Department Drivers

Departmental metrics might include:

- New sales (for appropriate departments)

- Division profitability

- Customer satisfaction factors

- Production quotas

- Project criteria (time and budget)

Individual Drivers

Key Performance Indicators (KPIs) designed to measure individual performance fall into two categories: hard measurements and soft measurements. Hard measurements include specific metrics calculated to reflect on the direct control of the participant. An example of a soft measurement would be the "completion of a specific project by a specific date."

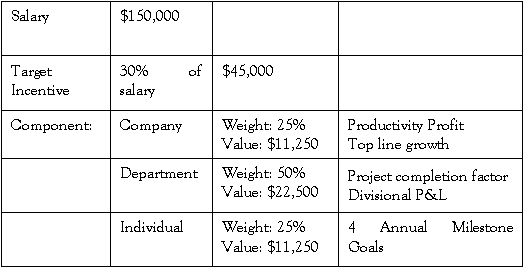

Pre-Determination

The incentive components should be established and communicated in advance of the incentive period (typically annually). The employee should be able to identify and understand the exact requirements associated with achieving his or her target incentive. For example, an incentive structure for a Department Head might be communicated as follows:

Tiered Awards

Incentive targets may be tiered to eliminate an "all or nothing" consequence. Commonly, three to five tiers are recommended. The payout results at each tier should be significantly greater than the preceding tier. Often, the plan grid (see below) can help produce this "tiering" effect.

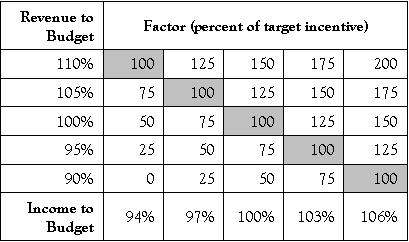

Executives are often provided with clear measurement grids to help balance non-correlated or complementary goals.

Below is an example that could be used for a company-wide grid.

In Conclusion

In Conclusion

There is no one perfect solution to designing an incentive plan that will be effective for every company. As a result, the way a company approaches the ideal is to understand best practice standards and frameworks and then work within that structure to customize indicators, measures and metrics that are suitable for your business. The selection of the type of incentive plan and its associated metrics should be based a company's culture, business model and goals. Here we have introduced two effective approaches to developing incentive plan indicators.

But regardless of the design you select, start with the right premise and use profit as your primary metric.

Ready to Get Started?

When it comes to building a compensation strategy, you can trust that VisionLink knows what works and what doesn’t. We are ready to share that knowledge with you.

Stay Connected

Receive free, ongoing access to updates on compensation and talent trends, reports, events, and more.