Is Incentive Compensation Viable in an Uncertain Economy? (Part Two)

April 21, 2025 • By Ken Gibson

In a previous article, we discussed why you should view your compensation plan like an investment portfolio. We suggested treating each pay and benefit component as an “asset class." As economic conditions improve or weaken, instead of stopping or removing specific plans and replacing them with others, you should “rebalance” your portfolio, just as you would your investment holdings. You would adjust the weight given to each program. The question is, what should those compensation "asset classes" be, and how do you effectively balance them?

That's the focus of Part Two of "Is Incentive Compensation Viable in an Uncertain Economy?"

The Governing Decisions

There are two decisions you must make before you can determine which specific pay plans to offer. The first is how you want to balance guaranteed compensation versus value sharing. The second is how much of your value sharing should reward short-term performance versus long-term. These decisions create the framework you will need to build flexibility into your pay strategy.

So, how do you decide what those balances should be?

Compensation Philosophy Statement

In the last article, we suggested that every good investment portfolio has a philosophy statement that guides the selection of assets. Your pay “portfolio” is no different. Your company needs a well-crafted compensation philosophy statement that, among other things, articulates the following:

- How the company defines value creation—the threshold at which it believes sharing value with employees is merited.

- With whom the company believes value should be shared—for both short and long-term performance (for example, everyone should be eligible for short-term value sharing but only senior management and above for long-term awards).

- What the company believes about sharing equity. If it favors giving stock, the statement should define the criteria for eligibility.

- Where the company wants to be vis-à-vis market pay for salaries.

- What balance the company wants to maintain between salaries and incentives, and on what metric(s) higher earnings potential will be based.

- How the company wants to balance rewards for short-term performance (12 months or less) and long-term (3 plus years), and who should be eligible for each.

- What the company believes the criteria should be for merit pay increases.

- How the company will balance its compensation elements in economic emergencies.

- How the company will balance its compensation elements during periods of prosperity.

More can be included in the philosophy statement, but it should address those issues at a minimum. Hopefully, it's apparent how the construction of this kind of statement can aid compensation decision-making during economic uncertainty or crises such as the one we experienced with the pandemic.

Balance Short & Long-Term Value Sharing

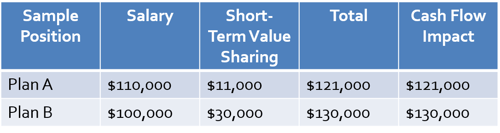

At the heart of constructing a rewards approach flexible enough to withstand wide economic swings is to adopt a balanced approach to value sharing. This means two things: 1) you tie a large portion of potential earnings to performance, and 2) you create the right balance between short and long-term incentives. The problem with most companies’ compensation strategies is that they place too much emphasis on rewards for short-term results and are laden with guarantees (salaries). As a result, when economic uncertainty sets in, the business has nowhere to pivot in its pay offering. It either has to reduce payouts or lay off employees. This is illustrated in the following chart, which shows two potential compensation offerings for a sample position.

Note that in this illustration, although Plan B puts more of the employee’s earnings “at risk,” if the requirements are met for achieving a full payout under either plan, the cash flow impact is equal to the employee’s salary plus their value sharing payout. In this scenario, during an economic crisis, the company has few options. It can freeze the incentive plan, it can ask the employee to work for a smaller salary, it can furlough the employee or it can lay the person off. Those are the only realistic options for managing the cash flow impact of compensation.

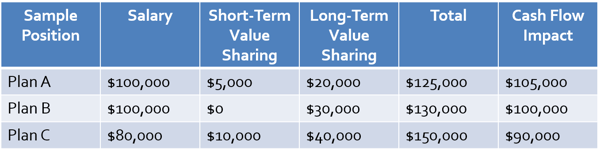

Contrast that example with the options shown in the chart below.

Note the flexibility introduced by adding just one additional component to the compensation offer—a long-term value sharing plan.

- We now have a range of options for mixing and matching salary, short-term incentives, and long-term incentives to create our compensation offering.

- We have options regarding the emphasis we place on rewarding short-term versus long-term performance.

- By shifting some of our earnings potential to a long-term value-sharing plan, we reduce the cash flow impact of our compensation offering. In every scenario, the cash flow impact is less than the total compensation potential in any of the plans.

To bring our discussion full circle, let’s apply the principles just discussed to an economic crisis such as the one we experienced during the pandemic. Suppose your rewards offering resembled the second chart more than the first when COVID-19 hit. Instead of simply freezing your annual bonus plan, asking employees to take lower salaries, or laying people off, you had an additional alternative. You could “rebalance” your compensation "portfolio.” Employees could be told that while you wouldn’t be in a position to pay their normal annual incentive that year, you would increase their long-term value sharing plan contribution based on hitting certain performance standards. Or, you could go to the employee who had a $100,000 salary with additional $30,000 of potential earnings through a bonus plan and say: “How about we lower your salary to $80,000 for now, with a $10,000 bonus potential but increase your long-term value sharing plan contribution to $40,000?” The employee now has a compensation package valued at $150,000, up from $130,000 for the year, and the company has reduced its cash flow exposure from $130,000 to $90,000. Why the reduction in cash flow impact? Because the long-term incentive isn’t expensed until it is paid out.

Once you grasp the concept of expanding your compensation “portfolio” to include a broader range of "asset classes" (pay components), you can begin to see the possibilities for minimizing the risk associated with your rewards approach. You can position yourself to offer your employees higher total earnings potential while simultaneously reducing your cash flow exposure. And with a broader and more varied pay offering, you can begin “mixing and matching” various scenarios until you arrive at a compensation allocation that properly reflects your company’s pay philosophy.

With economic uncertainty comes the need to reexamine your pay approach. Begin viewing incentive compensation as the means of creating greater flexibility in your rewards strategy.

Ready to Get Started?

When it comes to building a compensation strategy, you can trust that VisionLink knows what works and what doesn’t. We are ready to share that knowledge with you.

Stay Connected

Receive free, ongoing access to updates on compensation and talent trends, reports, events, and more.