Any chief executive that has a plan for growth should have a long-term incentive plan that helps communicate and reinforce that goal to employees. In our work with client companies, we find this to be the most common compensation ingredient missing. An effectively designed LTIP can focus key producers on the performance factors that will drive the growth of the business while simultaneously help retain that talent. That said, there are a myriad of incentive plans that can be considered. So, how do you determine which one is right for your company?

1. Define the Plan's Purpose

To choose a long-term incentive plan that suits your situation, you have to first determine your purpose in having such a plan. What outcomes do you want it to help you achieve? Are you trying to bring on additional owners? Are you recruiting a level of talent that expects an equity stake in the business? Is the goal to retain certain key employees but do so without diluting shareholder equity? Are you thinking of going public sometime in the future and want certain employees to benefit when that happens? Knowing the answers to these and other questions is a crucial starting point in your search for the right incentive plan.

2. Think in Terms of Value-Sharing

The other thing you’ll want to do in deciding which long-term plan is most suitable is to move away from the concept of “incentives” and towards “value-sharing.” There is a subtle but important distinction between the two. The term “incentive” implies a company will reward certain “behaviors”—and that the plan is the chosen mechanism to influence those behaviors. Too often, this becomes manipulative and the plan backfires. When it does, both employees and owners are left frustrated.

Value-sharing, on the other hand, rewards defined financial outcomes. It has a different philosophical foundation. Through this approach, ownership makes assumptions about what kind of value increases can be realized through the achievement of certain targeted or superior performance results. It then decides how much of that value it is willing to pay out or “share” with those who produce those results. It shares “the wealth,” if you will, from additional value that has been created (beyond the ongoing performance levels needed to sustain the business) with those that help produce it. At VisionLink, we call that additional value “productivity profit.” It’s a self-financing approach; no value is distributed unless that value has been first defined then produced. All of this should grow out of a compensation philosophy an organization creates to articulate how the company defines value creation and what it believes about how and with whom it should be shared.

3. Focus on the Role of a Long–Term Plan

Compensation is one way company leadership has of communicating where the company is headed (vision), how it’s going to get there (business model and strategy), what it needs its key people to do (roles and expectations) and how it will reward that effort (compensation). Long-term value-sharing is an effective way of rewarding those who create value that contributes to company growth. It requires enterprise leaders to envision what the future business will look like and the kind of employee, team, department and company performance that will be needed for it to be realized. The plan is then built on the self-financing foundation mentioned earlier. In that sense, compensation plans of this type should not be viewed as an additional “expense.” Rather, they represent an investment on the part of company leadership in building the productivity profit (net operating income attributable to the performance of the organization’s human resources) of the business.

4. Use a Decision Tree

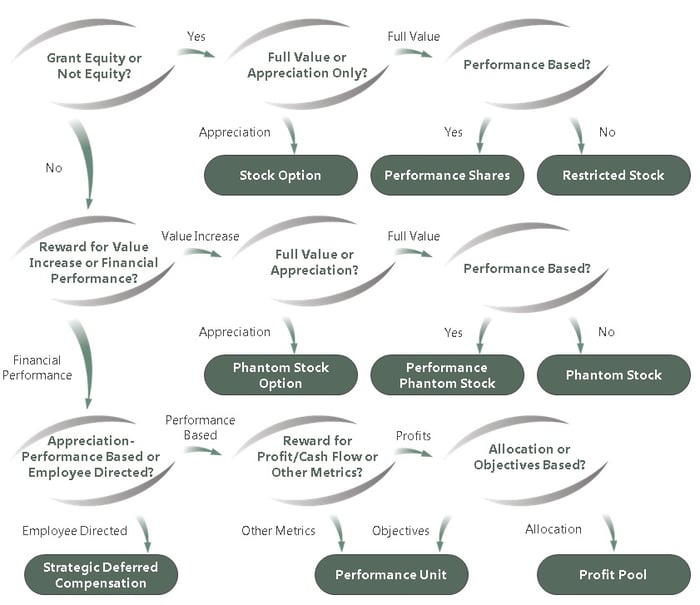

Ultimately, there are about nine different types of long-term value sharing plans that a company could consider—with potential variations on each of them. The one most suitable for a given organization depends on the answers to certain key questions. Knowing the right questions to ask can very quickly lead a company to conclude which incentive plan will most effectively create the focus wanted and provide rewards for performance that is consistent with the organization’s growth targets.

At VisionLink, we have found an LTIP Decision Tree to be an effective way to navigate those questions. The Decision Tree guides you through a logic pattern that helps you arrive at a solid conclusion about which plan is most suitable. It is essentially a process of elimination. For example, if you know you don’t want to share equity, then certain plans are automatically eliminated from consideration. On the other hand, you may be willing to share equity, but want to base the reward on an increase in the company’s value as opposed to its present value. This helps narrow down the kind of stock-sharing arrangement that would be appropriate. (You can find an interactive version of the Decision Tree shown below on our website by clicking here.)

Here are some of the questions you will find as you navigate this process—together with some of the plans that correspond with their answers:

- Do you want to grant equity? If yes, do you want it based on full value or appreciation only (stock option)? If full value, do you want it performance based (performance shares) or with limitations (restricted stock)?

- If you don’t want to grant equity, do you still want to find a way to reward employees based on company value increase or some other financial performance metric? If the answer is company value increase, do you want to reward full value or appreciation only (stock appreciation rights – SAR)? If full value, will it be company financed (phantom stock) or employee financed (deferred stock units)?

- If you want the value-sharing reward to be tied to financial criteria other than growth in company value, will it be performance/appreciation based or self-directed (strategic deferred compensation)? If performance based, will you reward for profit/cash flow or other metrics (performance units)? If profit/cash flow centered, will it be allocation based (profit pool) or objectives based (performance units)?

As you can see, this series of questions helps you build criteria that can be useful in determining the kind of long-term plan that will best fit the aims of your company. Such an analysis is important in determining the compensation strategies that will best fuel growth within the financial parameters ownership wants to consider.

Developing an LTIP (value-sharing plan) that will focus employees on long-term performance factors should be an important part of your company’s total rewards investment. The right plan can help engender an ownership mentality on the part of key people, will help you attract and retain premier talent and ultimately leads to enhanced economic value for both shareholders and participants. The key is to develop a plan that is synchronized with the vision, strategy, roles, expectations and value-sharing philosophy of the business and its owners.

Ready to Get Started?

When it comes to building a compensation strategy, you can trust that VisionLink knows what works and what doesn’t. We are ready to share that knowledge with you.

Stay Connected

Receive free, ongoing access to updates on compensation and talent trends, reports, events, and more.